Lessons learned early will pay off in the future.

Teaching kids about money can be a challenge. They may think you have an endless supply of cash and not understand the value of money. Teaching financial literacy will not only give your children an appreciation for what you provide, it will also help develop a baseline for a successful financial future. Here are some simple money lessons for both children and teens to help your kids grow up into financially responsible adults.

Money Management for Kids

Is your child begging you for the latest video game console or the hottest new toy? It’s important to use this as a way to teach valuable money lessons, including the importance of saving for what you want.

- The value of a dollar: Start your financial literacy lesson by choosing something your child wants to buy and explaining how much it costs. To truly learn the value a dollar, ask your child to earn all or part the cost. Depending on his or her age, this could come in the form of household chores, babysitting, pet sitting or dog walking. Look for local social media boards that list these kinds of opportunities to help your child find an appropriate way of earning money.

- Teach children about saving money: Encourage your child to save the money he or she earns. Putting money away into something tangible like a youth savings account will help your child understand the concept of watching money grow overtime.

- Spending money: Once your child has saved up enough money, it’s time to go shopping. This rewarding experience can help teach a valuable lesson and begin to establish lifelong, healthy money management skills.

Teenage Money Management

If you are the parent of a teenager, it’s important to regularly talk to your teen about money management and teach responsible spending and saving habits. Here are a few ways to help your teen understand how to manage money independently.

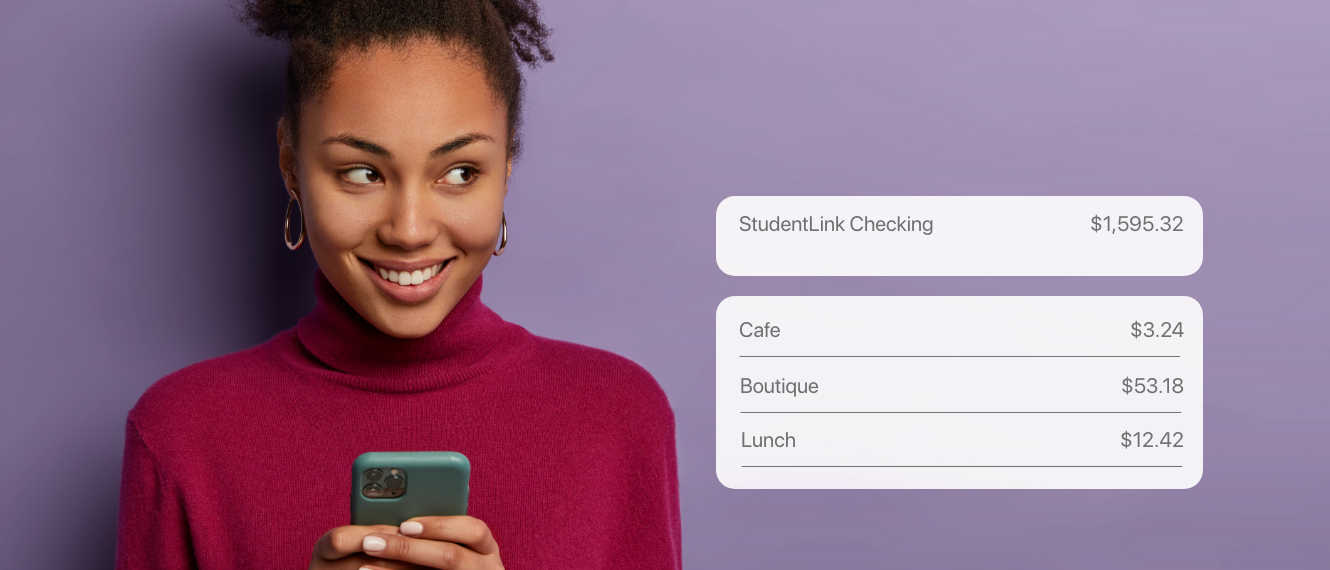

- Open a Bank Account: Is your teen interested in buying a car or going off to college someday? Both require savings and good money management skills. Opening a checking and savings account at First US Bank is a helpful way for teens to begin saving and managing money.

- College Savings: According to the College Board, the average cost of private college tuition is over $50,000 per year. This is a hefty expense for any family, so it’s important to start the conversation early on. Estimate how much it would cost for your child to attend a private, public or community college. If you’ve been contributing to an education savings fund, tell your child how much you think you’ll have saved and if he or she is expected to contribute the rest. This is also a great time to teach your teens about how to find and apply for scholarships or grants and how student loans work.

- Protecting Cards & Identity: If you allow your teens to have cell phones, credit cards and/or social media accounts, it’s critical to teach them how to protect themselves from identity theft. Unfortunately, thieves know to target those who have not yet learned to protect themselves. Ensure your teens secure their online banking accounts and store their credit cards in a safe place. They should also be vigilant about protecting debit card PIN numbers and their Social Security number. The more you teach them now about protecting their identities, the safer they’ll be when they’re out on their own.

Games and Apps that help teach the lesson

Money lessons can feel a bit like school, so to spice it up, consider adding some games or apps into the mix.

- Money Management for Kids: When you were a kid, you always dreamed of becoming a millionaire, right? This "When Will You Be a Millionaire calculator" allows your child to plug in different investment and savings options to watch their savings grow or shrink based on their decisions.

- Money Management for Teens: Although most money management is digital now, it’s still important to learn how to write a check and even balance a checkbook. Use this interactive “Writing a Check" money lesson to teach teens the basics.

- SmartyPig: A money management app that appeals to both children and teenagers, SmartyPig by Sallie Mae allows them to set their own saving goals and congratulates them as they are met.